In recent years, the adoption of tokenizing real-world assets has surged, marking a transformative phase in financial innovation. Tokenization, the process of converting tangible assets into digital tokens on a blockchain, is revolutionizing conventional financial systems, providing unprecedented opportunities for investors and market participants. While the concept of tokenization is not new, its application to real-world assets has gained momentum with the advancement of blockchain technology, particularly the Bitcoin blockchain. The Bitcoin blockchain stands out as a robust platform for asset tokenization, offering global accessibility, transparency, and enhanced security. Find valuable resources on investment education at https://immediatepeak.org/, an Investment Education Firm.

Understanding Tokenization

Definition and Concept of Tokenization

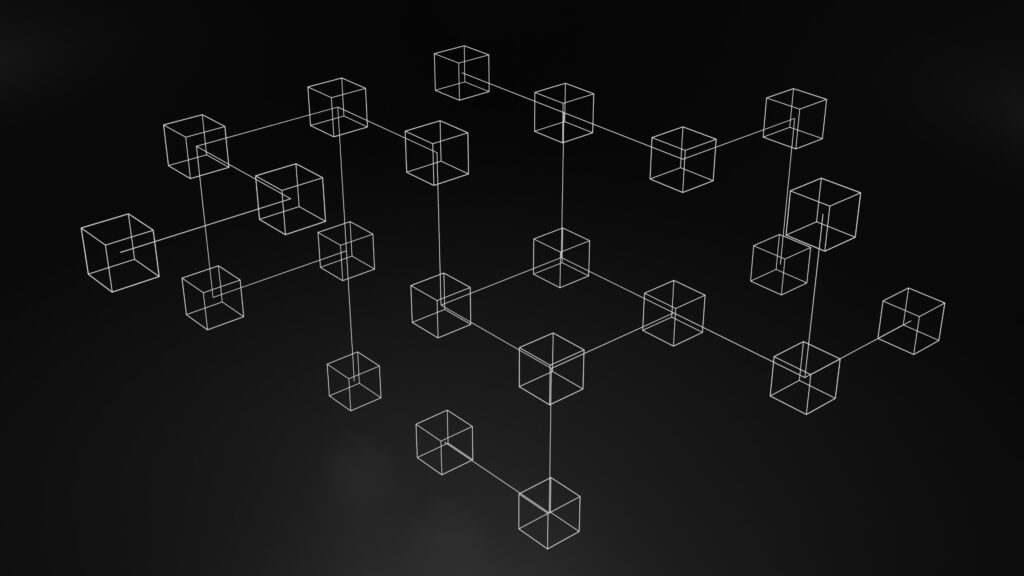

Tokenization is the process of representing ownership or rights to an asset through the creation of a digital token on a blockchain. These tokens can represent a variety of assets, including real estate, art, commodities, and more. By utilizing blockchain technology, tokenization ensures immutability, transparency, and traceability of ownership.

Types of Tokens Used in Asset Tokenization

Security Tokens: These tokens represent ownership in a tradable financial asset, providing investors with a share in the profits or underlying assets. Security tokens are subject to regulatory compliance.

Utility Tokens: Unlike security tokens, utility tokens grant holders access to specific products or services within a platform. They do not represent ownership but facilitate participation in a network.

Asset-backed Tokens: These tokens are pegged to the value of a tangible asset, such as real estate or precious metals. Asset-backed tokens combine the benefits of blockchain with the stability of real-world assets.

Benefits of Tokenizing Real-World Assets

Increased Liquidity

Tokenization introduces liquidity to traditionally illiquid assets, such as real estate. Fractional ownership enables investors to buy and sell small portions of an asset, democratizing access to markets and increasing overall liquidity.

Accessibility to Global Markets

The global nature of blockchain technology allows investors worldwide to participate in markets traditionally limited by geographical barriers. This inclusivity enhances market efficiency and fosters a more interconnected global financial landscape.

Fractional Ownership

Tokenization allows for the fractionalization of assets, enabling multiple investors to own a portion of high-value assets. This democratization of ownership opens up investment opportunities to a broader range of individuals.

Transparency and Security

Blockchain’s inherent transparency ensures that all transactions and ownership records are visible and immutable. This transparency, coupled with robust security features, reduces fraud, enhances trust, and mitigates the risk of asset tampering.

Challenges and Risks

Regulatory Hurdles

The regulatory landscape surrounding asset tokenization is still evolving. Jurisdictional variations and the lack of a standardized framework pose challenges for widespread adoption. Clear regulatory guidelines are essential to foster investor confidence and mitigate legal uncertainties.

Smart Contract Vulnerabilities

Asset tokenization heavily relies on smart contracts to automate processes and ensure compliance. However, vulnerabilities in smart contract code can lead to security breaches and financial losses. Continuous auditing and improvements are crucial to address these risks.

Market Volatility

The inherent volatility of cryptocurrency markets can impact tokenized assets. While blockchain offers transparency, the fluctuation of underlying cryptocurrencies may introduce a layer of uncertainty for investors.

Adoption and Trust Issues

The shift from traditional financial systems to decentralized blockchain solutions requires a paradigm shift in mindset. Establishing trust in blockchain technology and educating users about its benefits are essential for widespread adoption.

Use Cases of Asset Tokenization on the Bitcoin Blockchain

Real Estate

Fractional Ownership of Properties: Tokenization enables investors to own fractions of high-value properties, unlocking opportunities for diverse investment portfolios.

Increased Liquidity in Real Estate Markets: The ability to trade real estate tokens on secondary markets enhances liquidity and reduces the lengthy sales cycles associated with traditional real estate transactions.

Art and Collectibles

Tokenizing Art for Fractional Ownership: Art enthusiasts can now invest in high-value artworks through fractional ownership, making the art market more accessible.

Ensuring Authenticity and Ownership History: Blockchain’s transparent and immutable nature helps establish and verify the authenticity of artworks, preventing forgery.

Commodities

Tokenizing Precious Metals and Commodities: Investors can tokenize physical commodities like gold or silver, enabling seamless trading and ownership transfer on the blockchain.

Streamlining Supply Chain Management: Blockchain facilitates end-to-end traceability of commodities, reducing fraud and ensuring the integrity of the supply chain.

The Role of Smart Contracts in Asset Tokenization

Automating Transactions and Payouts

Smart contracts automate the execution of predefined agreements, ensuring seamless and transparent transactions. They facilitate instant and programmable payouts, eliminating the need for intermediaries and reducing transaction costs.

Escrow Services and Dispute Resolution

Smart contracts act as decentralized escrow services, holding assets until predefined conditions are met. In case of disputes, the programmable nature of smart contracts allows for transparent and automated resolution mechanisms.

Impact on Traditional Intermediaries

The use of smart contracts reduces reliance on traditional intermediaries, such as banks and brokers. This not only streamlines processes but also minimizes costs and potential points of failure in the traditional financial system.

Future Trends and Developments

Integration of Interoperable Blockchains

As the blockchain ecosystem evolves, the integration of interoperable blockchains is expected to increase, allowing seamless transfer of assets and information across different blockchain networks.

Evolution of Regulatory Frameworks

The maturation of regulatory frameworks specific to asset tokenization will play a pivotal role in shaping the industry. Clear and comprehensive regulations will encourage institutional participation and foster mainstream adoption.

Technological Advancements in Tokenization

Continuous advancements in blockchain technology, including improvements in scalability, security, and consensus mechanisms, will further enhance the efficiency and applicability of asset tokenization.

Potential Impact on Traditional Financial Systems

The continued growth of asset tokenization may challenge traditional financial systems, encouraging innovation and prompting traditional institutions to adapt to the changing landscape or risk becoming obsolete.

Conclusion

In conclusion, the tokenization of real-world assets on the Bitcoin blockchain represents a transformative shift in the financial landscape. The benefits of increased liquidity, global accessibility, fractional ownership, and enhanced transparency are reshaping how we perceive and interact with traditional assets. While challenges and risks exist, ongoing developments in technology and regulatory frameworks point toward a future where asset tokenization becomes an integral part of the global financial ecosystem, bridging the gap between traditional and decentralized finance. As the journey unfolds, the potential for innovation and positive disruption remains boundless.